Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I may upset some people with this, but here it goes.

My list of protocols I trust, and those I don't trust with my money.

Let's start with the last category. A thread 1/11 🧵

2/ Don't trust: @ethena_labs / #ENA / #USDe

This basis trade synthetic token remains untested.

Until it passes a proper bear market, USDe is still a concept that's not validated.

Reason to be concerned? USDe mcap is growing big fast = higher risk when bears return.

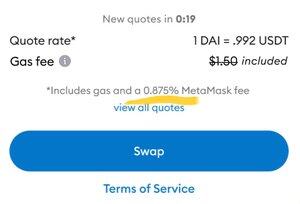

5/ Don't trust: @MetaMask wallet

Popular wallet, but lacking in terms of user security and UI.

Plus high fees for their native swap. Best to seek alternatives. I got a suggestion later in this thread.

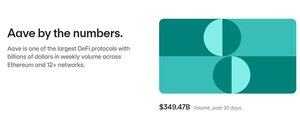

6/ Trust: @aave

Biggest money market in crypto and passed a bear market already.

They do proper due diligence and their governance is one of the best in the space. @lemiscate

Highly recommended if you want to put your assets to work or get some nice loans.

7/ Trust: @GMX_IO DEX

Before we had Hyperliquid, people got excited about $GMX.

Recently, they had a hacking incident and came out of it without issues and extremely professional.

They passed a bear market well and it's the one place you get paid to buy Bitcoin.

8/ Trust: @arbitrum L2

It's my to-go chain for most things. Works flawlessly.

They lead the market in the L2 space and deserve it.

The best protocols (@HyperliquidX / @GMX_IO) built on top of Arbitrum L2. That's the validation you seek.

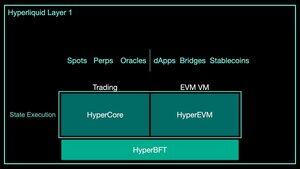

10/ BONUS: @HyperliquidX

I trust @chameleon_jeff and the core chain used for his DEX.

However, HyperEVM and most protocols built there are high-risk imo.

Be careful with your money farming untested protocols. Don't risk more than you can afford!

11/ I will review 10 more protocols posted by those that reply first to this thread.

Drop them in the comments and share this thread.

Like and follow @DU09BTC for more alpha!

48,09K

Johtavat

Rankkaus

Suosikit