Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

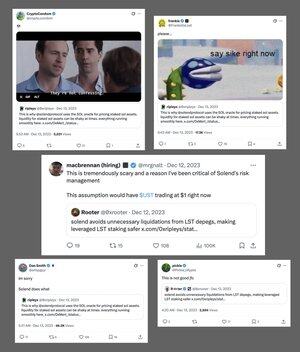

we got so much shit for doing this with mSOL/SOL two years ago, and now it's standard practice.

where are the critics now?

7.8. klo 02.01

13/ Coming back to USDe, Aave recently made two key architectural decisions that enabled the USDe loop strategy to thrive.

Firstly, after risk providers highlighted significant liquidation risks for sUSDe lenders due to potential price depegs, Aave DAO pegged USDe directly to USDT's exchange rate.

This decision eliminated the primary risk factor of liquidations, leaving only standard interest rate risk inherent in carry strategies.

@macbrennan_cc

8,34K

Johtavat

Rankkaus

Suosikit