Tendencias del momento

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mis 2 centavos: A la gente le fascinan las cajas negras que les hacen ganar dinero desde al menos el trading de divisas.

Todo el mundo quiere delegar el trading/inversión a algún robot inteligente que genere "ingresos pasivos"; esto no funcionará bien para el trading competitivo de suma cero, ya que será superado por profesionales con sus propios modelos, pero puede funcionar bien con la inversión pasiva.

Después de que se resuelvan los problemas iniciales y los LLM se ajusten mediante RLHF para este caso de uso, al menos serán mucho mejores siguiendo sólidos principios de gestión de riesgos que las personas.

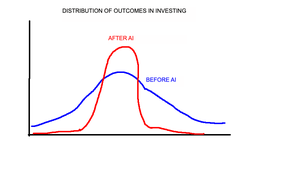

Veremos colapsar ambos extremos: menos personas se arruinarán completamente, pero también habrá menos que superen el rendimiento.

La gente entonces se preocupará por la "era de la curva media" en la inversión, ya que básicamente todos usan los mismos modelos haciendo lo mismo, pero luego te das cuenta de que ya estamos allí con la inversión pasiva y los ETFs; solo se exacerbará y se retorcerá un poco.

Mientras que ahora la inversión pasiva tiene un sesgo inherente hacia los grandes ganadores (la forma en que se ponderan los índices), la inversión pasiva impulsada por IA nivelará un poco el campo de juego al no estar tan sesgada contra las pequeñas capitalizaciones.

Los marcos de tiempo más cortos y los segmentos conocidos serán completamente dominados por asesores financieros de IA, pero en marcos de tiempo más largos y en campos más idiosincráticos, los humanos aún podrán mantener una ventaja.

30 jul 2025

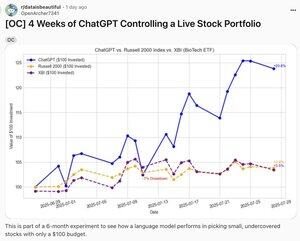

someone on reddit let ChatGPT manage a $100 stock portfolio for four weeks and beat the market by 23%.

here are 14 things it means for you, markets and the future of finance:

1. there will be a massive market crash caused by too many AIs making the same trades. when millions of ChatGPT instances start following similar logic, you get dangerous herding behavior. the reddit user asked to buy microcaps and it ONLY bought biotech. imagine this at scale.

2. companies will start optimizing press releases for AI readers, not humans. the businesses that write in "AI-parseable" language will get disproportionate algorithmic attention and investment.

3. we'll see the rise of "AI investment clubs" where people pool money and let collective AI strategies compete. it'll be like fantasy football but with real money and ChatGPT as your quarterback.

4. financial advisors will become "AI prompt engineers." instead of picking stocks, they'll craft the perfect instructions for AI systems and charge clients for their prompting expertise.

5. day trading will be completely dominated by AI within 18 months. humans won't be able to compete with AI that can process earnings calls, news, and social sentiment in real-time.

6. every retail investor will have an AI trading assistant by 2027. not managing their money directly, but whispering suggestions in their ear based on news they'd never read themselves.

7. investment newsletters will pivot to selling "winning prompts" instead of stock picks. why give you fish when they can sell you the AI fishing rod?

8. someone will build a "social network for AI trading strategies." think github for investment prompts where successful strategies get forked and improved by the community. a16z prob funds it

9. the SEC will create new regulations around "algorithmic investment advice." they'll scramble to figure out who's liable when your ChatGPT loses your retirement savings.

10. google searches for basic financial terms will plummet by 50%. why google "what is a P/E ratio" when you can ask your AI assistant to explain it while analyzing your portfolio?

11. the phrase "my AI beat your AI" will become the new "my dad can beat up your dad." AI performance bragging becomes a social status symbol.

12. your bank will offer "AI portfolio management" as a free checking account feature. basic AI investing becomes as common as mobile deposits.

13. AI will create the first "algorithmic insider trading" scandal. when AI can predict earnings better than executives, the definition of insider information gets blurry.

14. the stock market will have its first "AI flash crash" caused by recursive feedback loops. millions of AI systems reacting to each other's trades in milliseconds.

the reddit post went viral because it feels like a glimpse into a world where everyone has access to institutional-level analysis. but really, it's showing us how quickly we're willing to hand over decision-making to systems we don't understand.

maybe that's not entirely bad though. most people are terrible at investing anyway, they buy high, sell low, and let emotions drive every decision. if AI can remove the emotional component and stick to data-driven

strategies, maybe we'll all end up better off. And plus financial advisors charging ~1% AUM has been unchallenged for too long.

What do you think?

566

Parte superior

Clasificación

Favoritos