Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Lately, there have been a few incredible investment reports on ETH, created from within the Ethereum community, but one standout I feel deserves more respect is the Trustware Report by @Consensys.

Here's a few takeaways as long term investor in ETH...

4/ Ethereum possesses a moat that is social, technical, political, and economic.

It is evident in many ways:

+ Unmatched economic security

+ Compounding network effects

+ Proven adaptability

+ Institutional validity

+ 100% uptime over 10 years

7/ ETH remains the world's second largest digital asset by market cap.

Meanwhile Ethereum is the world's #1 smart contract platform and the backbone of DeFi.

+ $90B locked in DeFi

+ >65% of DeFi TVL is locked in Ethereum + L2s

+ >54% of all stablecoins ($150B)

9/ Beyond its role securing the network, ETH serves as money and pristine collateral within these DeFi economies. Plus, it generates a yield of 3.3% when staked.

As a result of the rapidly increasing economic demand for ETH, it is on an inevitable path to a multi-trillion-dollar valuation.

My base case is ETH is a $20T asset. Full stop.

For all Ethereum makes possible, ETH is worth more than the value of gold. It is a programmably scarce digital asset, powering asymmetric opportunity to tens of trillions in future digital finance, a trusted digital economy which stands to absorb a substantial amount of the $780T in global assets which will rationally seek greater capital efficiency onchain.

TradFi isn't going to sit by while their peers unlock trillions in new economic activity. They're going to compete. So in order to compete, they will seek the best trustware hosting the most liquidity and most competitive onchain yields--that's on Ethereum.

With all this in mind, ETH easily stands to be valued much higher than whatever physical gold or BTC digital gold warrants.

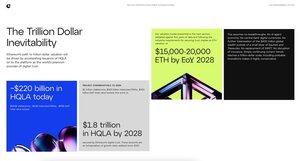

10/ This report concludes with painstaking detail and analysis to provide reasonable forecasts for the price of ETH over the next 3-4 years, but here's the takeaway for year-end 2025 price targets vs year-end 2028 targets.

I think the reflexivity in crypto markets will take us much higher in a shorter amount of time but I appreciate the thoughtful more conservative analysis they provide.

😇

End/ The report concludes with a few takeways:

"Ethereum is undergoing a fundamental transition, maturing from a speculative platform into the indispensable layer of underlying trust provision for an increasingly digital global economy."

"As with previous commodities and industrial

revolutions, owning the source of the critical new

commodity is where strategic advantage lies and

where the outsized gains accrue. For investors, that

means treating ETH less like a tech equity proxy

and more like a strategic reserve asset. Ethereum's

role as global trustware and the premium provider of

digital trust, positions it to capture significant value

from the ongoing digitalization of finance and

commerce."

For the full report, follow @Consensys and check it out here...

5,19K

Johtavat

Rankkaus

Suosikit