Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

陈桂林

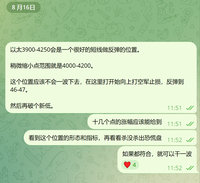

The big coin is too weak, the altcoin has a 2% stop loss, and Ethereum has a 1% stop loss, with an opening price of 4283.

This market really makes you itch if you don't trade, but if you do trade, it just causes anxiety. Better to just lie flat. 🌚🌚

陈桂林21.8. klo 10.26

$BTC $ETH There are signs of a bottom forming on the small scale.

This is a pullback after breaking the bottom, so it's a good time to add some positions and test the waters, and also look into altcoins since they have dropped quite a bit, which is tempting;

If this wave of rebound isn't strong, then it must be the fault of BTC, as it's been too weak;

The strategy is still to play the range, if done correctly, you might earn a little, but if done wrong, you'll just give back what you earned recently.

19,66K

$BTC $ETH There are signs of a bottom forming on the small scale.

This is a pullback after breaking the bottom, so it's a good time to add some positions and test the waters, and also look into altcoins since they have dropped quite a bit, which is tempting;

If this wave of rebound isn't strong, then it must be the fault of BTC, as it's been too weak;

The strategy is still to play the range, if done correctly, you might earn a little, but if done wrong, you'll just give back what you earned recently.

45,6K

The closer it gets to the key support level, the more intense the bulls' resistance becomes, which is normal.

After scanning the market, my personal feeling is:

1. The bulls' resistance for Bitcoin isn't particularly intense;

2. As for Ethereum, after this round of excitement, it has become a gathering place for retail investors. The main funds are using the emotional aftershocks to stir things up, and the lines drawn are even more exaggerated than those of the altcoins.

Conclusion: It's not a big opportunity.

The more I lie down, the flatter I get, and the lazier I become. After enjoying too many good things, I really don't want to look at the small opportunities anymore; I'm becoming picky.

陈桂林20.8. klo 11.24

1. $BTC Technical Analysis

The rise that started from 111920 is the final segment of the overall rise that began from 74508;

The current decline is nearing the point of consuming this last bit of the rise, and the level may have expanded to a correction targeting the rise from 74508 to 124474;

The rise from 74508 to 124474 may be the fifth segment of the overall rise that started from 15476;

So let's first assume a few key support levels and observe the price behavior when it reaches them, from near to far: 112000 (the starting point of the last segment), 108706 (today's price, daily MA120), 92503 (today's price, 3-day MA120), 74508 (the starting point of the ending diagonal).

Indicators:

The daily indicators for BTC are neutral, bearish below the daily level, and in a corrective process from a high position (overbought) above the daily level;

It is particularly important to note that if the daily bullish trend continues to weaken, the weekly MACD will form a death cross, which is a high certainty indicator at a larger scale. If the weekly death cross is confirmed, it will either be a long-term correction (from 2024-03 to 2024-08) or a violent drop (from 2025-01 to 2025-04).

2. $ETH Technical Analysis

ETH has been representative in the overall market trend that started on April 8, both in terms of the magnitude of the rise and in driving market sentiment; ETH has replaced BTC's position in this round.

The rise from 3354 can be seen as wave 3 of 5 or wave 5 of the rise that started from 1300 (uncertain);

Currently, the daily indicators are in a correction process, and the MACD has not returned to the 0 axis;

The larger scale is lagging behind BTC, and it is believed that it is still good to follow the market. If the market is good, ETH will perform better than the market, but if BTC drops, it cannot stand alone.

3. Others

Yesterday's decline was a resonance of the overall financial market; a few days ago, only the crypto market was down, while the US stock market had no reaction. Yesterday, both the US stock market and the crypto market fell together.

If the US stock market is not doing well, the crypto market cannot thrive independently. It should be noted that the main line of this round, the BTC and ETH ETFs, are all funded by big players in the US stock market.

1. The current overall adjustment has not accelerated; small-scale ups and downs are occurring, but looking at the daily closing, they are mostly solid bearish candles;

2. After scanning the macro pushes and policy pushes, I haven't seen any reason to rush towards 74000;

Currently, the market is in a phase where I am not very clear on what to do, so the strategy taken is to give up small opportunities and only grasp slightly larger opportunities that I can understand. After all, as Guillin once said, the larger the scale, the higher the stability;

One fact is that since April, we have already experienced over four months of rising.

36,33K

1. $BTC Technical Analysis

The rise that started from 111920 is the final segment of the overall rise that began from 74508;

The current decline is nearing the point of consuming this last bit of the rise, and the level may have expanded to a correction targeting the rise from 74508 to 124474;

The rise from 74508 to 124474 may be the fifth segment of the overall rise that started from 15476;

So let's first assume a few key support levels and observe the price behavior when it reaches them, from near to far: 112000 (the starting point of the last segment), 108706 (today's price, daily MA120), 92503 (today's price, 3-day MA120), 74508 (the starting point of the ending diagonal).

Indicators:

The daily indicators for BTC are neutral, bearish below the daily level, and in a corrective process from a high position (overbought) above the daily level;

It is particularly important to note that if the daily bullish trend continues to weaken, the weekly MACD will form a death cross, which is a high certainty indicator at a larger scale. If the weekly death cross is confirmed, it will either be a long-term correction (from 2024-03 to 2024-08) or a violent drop (from 2025-01 to 2025-04).

2. $ETH Technical Analysis

ETH has been representative in the overall market trend that started on April 8, both in terms of the magnitude of the rise and in driving market sentiment; ETH has replaced BTC's position in this round.

The rise from 3354 can be seen as wave 3 of 5 or wave 5 of the rise that started from 1300 (uncertain);

Currently, the daily indicators are in a correction process, and the MACD has not returned to the 0 axis;

The larger scale is lagging behind BTC, and it is believed that it is still good to follow the market. If the market is good, ETH will perform better than the market, but if BTC drops, it cannot stand alone.

3. Others

Yesterday's decline was a resonance of the overall financial market; a few days ago, only the crypto market was down, while the US stock market had no reaction. Yesterday, both the US stock market and the crypto market fell together.

If the US stock market is not doing well, the crypto market cannot thrive independently. It should be noted that the main line of this round, the BTC and ETH ETFs, are all funded by big players in the US stock market.

1. The current overall adjustment has not accelerated; small-scale ups and downs are occurring, but looking at the daily closing, they are mostly solid bearish candles;

2. After scanning the macro pushes and policy pushes, I haven't seen any reason to rush towards 74000;

Currently, the market is in a phase where I am not very clear on what to do, so the strategy taken is to give up small opportunities and only grasp slightly larger opportunities that I can understand. After all, as Guillin once said, the larger the scale, the higher the stability;

One fact is that since April, we have already experienced over four months of rising.

74,1K

Trading is about taking one step at a time, so don't mock the teachers who say, "It could go up, it could go down, and we can't rule out the possibility of sideways movement" anymore.

Predictions and plans for August 16

Opportunity to buy on August 18

On August 19, if the situation doesn't meet expectations, go with PLAN B

What is a trader?

A trader has trends in their heart and patterns in their eyes.

49,64K

The rebound is a bit weak and hasn't provided the expected smooth rebound market;

According to the structure, E should have completed its move and should be heading for a downward correction. Looking at that line at eight o'clock, it seems to indicate something, but it was pushed down as soon as it went up. Overall, it's still weak, and it's not time to sell the house yet.

The competition between bulls and bears here is quite intense, so just remember to set stop-loss orders when trading.

18,71K

A one-sided decline is never considered a difficult market. If it were one-sided, wouldn't everyone just short it?

So, what is a "repayment market"? It's one that constantly gives you hope to go long, while continuously triggering your stop-loss or trapping you. When you finally decide to turn around and stop going long to go short, then a big wave of increase happens. Once you chase the rise, oh no, there's another wave of decline waiting for you.

The market keeps switching between different levels, without any rules or reasons.

When most people have been stopped out and have lost their enthusiasm, and another large portion of people are trapped, with most of those trapped eventually cutting their losses, only then does the difficult market approach its end.

It is still impossible to confirm the size of this adjustment level because different levels are inherently nested within each other. Even with a pre-set script, the main funds still have to ride the donkey while reading the script. They follow the market's reactions and choose the most cost-effective way to operate.

陈桂林11.8. klo 13.45

In the next 1 to 2 months, 90% of people will return the money they made in a simple market. I'm saying this, my name is Chen Guilin.

62,85K

Ethereum and Bitcoin have both risen, now it's $SOL's turn, well, now it's SOL's turn to drop!

陈桂林13.8. klo 11.06

Well, this round's doomsday vehicle is $SOL, hahahaha.

40,03K

Isn't it awesome? Isn't it an eternal bull market? Isn't Ethereum going to $10,000?

Why did it drop this time? What’s the reason? Was it the interest rate hike? Or is it because Trump isn't supporting crypto anymore? Or is it that LEE and Mike Saylor aren't buying anymore?

Why?

陈桂林14.8. klo 21.11

Huh? Why did the decline widen while taking a shower? Aren't the bulls impressive anymore?

90,02K

In this market, not losing is equivalent to making a profit.

I also opened a position yesterday, but it was a short position, opened at 4520 with a 1% stop loss, and it got hit perfectly.

Then, it dropped in the early hours; I mean, who stays up late on a weekend to watch the market!

When I opened my eyes in the morning, it was already 9 AM, and I missed the 6 AM rebound, which had already come down, and then there was nothing more to do but watch.

陈桂林18.8. klo 09.54

1. A few days ago, it was mentioned that the next month is the time to repay debts, and some people still don't believe it;

2. Yesterday, during the weekend, liquidity was low, and those who wanted to catch the bottom are the ones who need to repay debts;

3. Adjustment requires either time or space;

4. Indicators, sentiment, structure, and news all need to be given a chance before buying; there's no rush now;

5. Did those who tried to catch the bottom yesterday get stuck, stop-loss, or successfully take profits?

18,63K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin