Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

@Uniswap v4 Hooked Pools: Data, Design, and New Dynamics 🧪

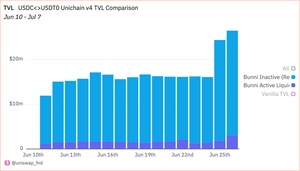

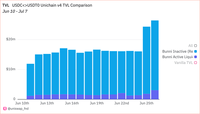

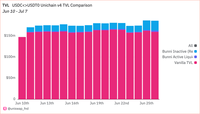

Hooks on @unichain aren’t just growing — they’re changing how we measure liquidity, fees, and LP earnings.

If you care about AMMs, DeFi data, or how incentives shape liquidity — read on 🧵👇

🐰 Bunni

Classic AMMs let idle LP liquidity just sit there.

Bunni rehypothecates it into lending protocols like Euler to earn extra yield.

So Bunni pools split liquidity into:

- Active → swaps

- Idle → lending vaults

🧠 Smart capital efficiency

(source:

That means Bunni LPs earn:

- Trading fees 💸

- Rehypothecated yield 📈

Despite lower TVL, they’re earning more in aggregate fees than the same pair vanilla pool.

(source: )

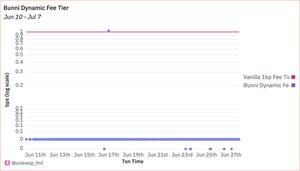

@bunni_xyz Oh, and Bunni pools also use dynamic fees, not fixed ones.

The hook emits the fee per swap — so data infra must shift from indexing pool init to tracking per-swap fees.

It’s a whole new paradigm for fee tracking.

(Source: )

2,87K

Johtavat

Rankkaus

Suosikit