Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

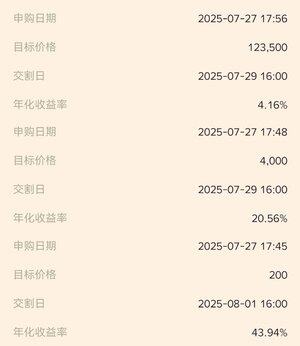

I made a dual currency investment, and the delivery date is 7.29-8.1.

In terms of holding coins, sell high.

Choose a slightly higher price, and the interest is lower than the middle.

Reason: Personally, I subjectively judge that there will be no violent rise in recent days, and there is a high probability that it will be a shock (it doesn't matter if it goes down in the short term). There is too little interest on the flexible period, so make a short-term dual-currency investment to make some extra money.

Hold the U part and buy low.

The price and interest are in the middle for the same reason.

After yesterday's pull-up, the same high selling price yield soared, and I thought maybe it was just a wave? Today, Bitcoin and Ethereum are delivered into U, and then I buy them back after the shock, charge a wave of interest and make a wave of difference, and the result is a little bit...

43,44K

Johtavat

Rankkaus

Suosikit