Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Wanna catch the top or bottom of $BTC at the right time to nail your entry or lock in profits? Then study these indicators, they’ll help you get there:

🔻 Spotting the Top:

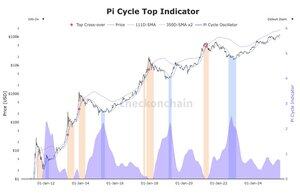

1. Pi Cycle Top

Flags the cycle peak when the 111DMA crosses above 2×350DMA.

2. MVRV

When market value / realized value goes above 3.5-4, the market’s overheated - cycle top often follows.

3. Investor Tool (2Y SMA ×5)

Tracks price relative to its 2-year moving average (×5). A cross above usually marks the end of a bull market.

4. AVIV-Z & STH-MVRV-Z Bands

Show price deviation from historical norms. 2–3 sigma and up = possible top.

5. Bitcoin Cycle Extreme Oscillators

Combo of SOPR, Puell Multiple, and Reserve Risk. A reading above 0.85 typically signals a local top.

🔺 Spotting the Bottom:

1. Hash Ribbons

Miner capitulation signal. When 30DMA drops below 60DMA, it’s often near the cycle low.

2. MVRV < 1.0

Means the average holder’s underwater. Historically a strong bottom signal.

3. Investor Tool (2Y SMA)

The lower band (2Y moving average) acts as macro support, typically where bottoms form.

4. Bull Market Correction Drawdowns

Drawdowns of 70–85% from the peak have historically marked long-term bottoms.

5. LTH MVRV Momentum

Negative momentum shows capitulation from long-term holders, another bottom indicator.

Use a combo of these indicators to spot cycle reversals and manage your entries/exits like a pro.

These tools will help you with that - @capriole_fund and @_checkonchain

4,58K

Johtavat

Rankkaus

Suosikit