Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ well done @JasonYanowitz and @Blockworks_ team

The Blockworks "Treasury Companies" Market Data is a developing trove of metrics that are dynamically updated for its relevance by having well-defined inputs.

Early days but excited to see what features they will add! 👇

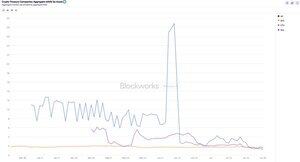

2/ Trading Volume by Asset

When you reframe the data as market share, it becomes abundantly clear that Ethereum is making a big dent. I tis over 50% on a daily basis on certain days over the past few weeks in July!

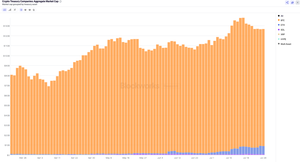

3/ Aggregate Market Cap

But make no mistake, that we are all still living in Bitcoin's world. $118Bn vs $8Bn is a huge spread, especially in the context for credit and how much more ETH NAVs needs to grow to access this lucrative market.

4/ Aggregate mNAV by Asset

Part of why Ethereum was so strong can be explained by seeing how expansive mNAV was for ETH for most of July, but since has come in. Nice to note that the mNAV definition is also clearly defined: Aggregate Market cap divided by aggregate NAV

5/ There isn't a whole lot of other NAV metrics, like BPS or BTC Yield, or any of that stuff. For that, there's other websites you can go to.

To compete with edge, my suggestion for BW would be to dig into data around volatility, options market, and credit instruments etc.

24,72K

Johtavat

Rankkaus

Suosikit