Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

.@trondao posted 10M daily txs, $3B DeFi volume, and integrations across 20M merchants.

Q2 was all signal.

From 10M daily txs to US policy summits, here’s what stood out 👇

2/ TRON’s dev game is maturing.

- Upgradeable smart contracts via EIP-1967

- Full ARM support for mobile-first decentralization

- Native THORChain swaps (BTC, ETH, ATOM—no wraps)

That’s modular, mobile, and multi-chain. The infrastructure play is real.

3/ In DeFi:

- SunSwap kept monthly volume >$3BJustLend tripled deposits in Q1 to $740M

- Chainlink oracles integrated for real-time pricing and liquidations

- TRON-based stablecoin payments now live across 20M merchants in SEA

It's composability with actual usage.

4/ Enterprise went full throttle:

Strategic deals with MoonPay, Kripton Market, and World Liberty Financial

Filed for a TRON ETF with staking yields

Co-hosted Harvard Blockchain Conference

And yes… Eric Trump’s USD1 stablecoin now lives on-chain.

Regulatory push meets meme capital.

5/ Onchain?

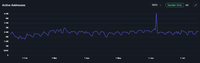

- Daily txs between 7.5–9.5M, peaking at 10M

- 2.3–2.7M daily active addresses

- Black Hole address still dominating txs — protocol-level functions humming

CEXs like Binance, Bybit, OKX driving flow.

end/ TRON isn’t just surviving. It’s scaling.

Full deep dive:

16,62K

Johtavat

Rankkaus

Suosikit