Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

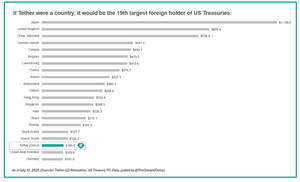

Tetherillä on nyt suoraan hallussaan 106 miljardia dollaria Yhdysvaltain valtionkassoista, mikä tekee siitä suuremman velkojan Yhdysvalloille kuin G7-maat Saksa (102 miljardia dollaria) ja Italia (alle kynnysarvon). Jos se olisi maa, sen suorat omistukset tekisivät siitä maailman 19. suurimman ulkomaisen omistajan

Johtavat

Rankkaus

Suosikit