Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

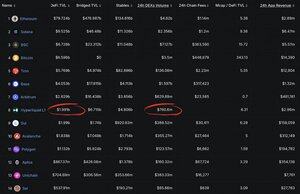

Hyperliquid's L1 - which isn't even their main product - is crushing the "premium L1s" that consumed years of development and massive VC rounds:

HyperEVM: $1.99b DeFi TVL, $760m DEX volume

- $SUI: Same TVL, half the volume, $35b FDV

- $AVAX: $1.83b TVL, $355m volume, $15.4b FDV

- $APT: $867m TVL, $160m volume, $4.95b FDV

Hyperliquid's main business, Hypercore, makes ~$3.5m in daily revenue with 93% flowing back to $HYPE buybacks on the open market.

These other chains?

No meaningful revenue, let alone any passed back to token holders.

Still trading on stale "L1 premium" narratives while getting outperformed by what's essentially Hyperliquid's side project.

With native USDC coming to HyperEVM, Arbitrum's "Hyperliquid bridge" utility evaporates overnight.

Flippening incoming there too.

hyperliquid.

52,46K

Johtavat

Rankkaus

Suosikit