Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Yesterday in WSO we covered the top 3 tokenization platforms by onchain value across all of crypto

🚨 Here's what you missed:

4. Tokenization Platforms: The Current Power Players

The tokenization of real-world assets is no longer a fringe sector off in the corner of the crypto industry. It has become one of the most dominant verticals in all of blockchain and shows no signs of slowing down. As TradFi institutions continue pouring in, owning the infrastructure stack to capture that momentum has turned into a high-stakes race. At the front of that race are a handful of tokenization platforms managing billions in tokenized treasuries, equities, bonds, commodities, credit, and funds. Below, we spotlight the largest platforms by total value, as tracked by @RWA_xyz.

The Big 3

Together, these three tokenization platforms control ~53% of onchain market share, each with over $1B in total value.

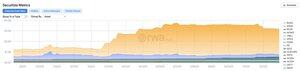

🥇Securitize — $3.2B TVL | 25.1% Market Share

@Securitize is the current market leader in regulated tokenized assets. It provides the infrastructure behind many of the largest onchain treasury and equity offerings to date, including @BlackRock’s BUIDL fund and tokenized shares for institutions like @apolloglobal, @vaneck_us, @KKR_Co and @hamilton_lane.

The platform supports tokenization across a wide range of asset classes, such as U.S. Treasuries, public and private stocks, institutional funds, and real estate, and is active on more than 10 different Layer-1 blockchains.

Securitize is a registered transfer agent, broker-dealer, ATS, and fund administrator. Its vertically integrated model offers institutions a single, compliant platform for issuance, custody, and trading. By managing the full stack in-house, it reduces counterparty risk and streamlines institutional entry into onchain markets. This positioning has proven effective, as evidenced by the top asset issuers leveraging Securitize to issue their products onchain.

Top 5 Assets

---

🛑 Want to learn about Securitize's Top 5 Assets, along with a full break down of the rest of the Big 3?

👉 Read Wall Street Onchain (08.05.25) now

3,03K

Johtavat

Rankkaus

Suosikit