Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Block $XYZ introduced a new metric for Cash App called “banking actives”, likely in response to the recent disclosures from Chime $CHYM:

✔️ "If we define a banking customer based on how people use money in their everyday lives — depositing a paycheck or spending at least $500 per month across Cash App — we would have 8 million banking actives, growing 16% YoY"

✔️ "And if we count anyone who deposits $200+ in paychecks or transacts 15+ times a month, we’d have ended June with 11 million banking actives, adding over 1 million actives in the past year."

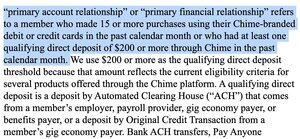

✔️ Chime refers to a primary financial relationship as "a member who made 15 or more purchases using their Chime-branded debit or credit cards in the past calendar month or who had at least one qualifying direct deposit of $200 or more through Chime in the past calendar month."

✔️ "We have built trusted relationships with 8.6 million Active Members, with 67% [ 5.76 million ] of them relying on Chime to serve as their primary financial relationship as of March 31, 2025"

So, apples to apples: 11 million primary relationships [ June 2025 ] for Cash App vs. 5.76 million for Chime [ March 2025 ]

2,59K

Johtavat

Rankkaus

Suosikit