Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Recession? Just now, a "friend" of mine shared with me the consumption data for July that he saw:

1. There was a slight slowdown in April and May, but the growth rate returned in June and was even stronger in July, with a growth rate of 5-5.5% compared to the same period last year, including credit cards, debit cards, checks, ZELLE payments, and ATM cash all together.

2. Interestingly, fast food has a slightly higher growth rate compared to upscale restaurants; clothing is strong due to summer; entertainment is robust; airfares have come back a bit. There are indeed many details, but overall, people are still spending. This is not a small sample, with $25 trillion in consumption.

3. How do you view the use of money—through borrowing or pulling from bank accounts? Credit quality is very strong, and the industry is doing well; there is actually a lot of room for borrowing. The space for HOME EQUITY LOAN is still 30% lower compared to before the pandemic, while housing prices have risen, so there is a lot of borrowing capacity, and delinquency rates are good and trending down.

4. Middle-income families are relatively tight, and GEN Z's spending growth has slowed, while older generations tend to spend more, so many issues are there. But I often say, "Don't listen to what people say they will do; look at what they actually do. What they are doing is still spending."

5. So what about employment? Our economists say that due to immigration issues, the supply side of the labor market has decreased significantly, which could lead to wage increases. Because of tariffs, companies have indeed slowed down hiring, but they are not laying off employees, which is often overlooked by the market. The unemployment rate is still at 4.2%. In our careers, 5.5% is considered full employment, and we can get through this.

6. Tariffs, do you think we will see them? In the past month, I have been communicating with some companies on the West Coast, and for those companies, what they want to know most is: what exactly are the tariffs? Many companies are already preparing for next year, and once certainty is established, the economy can safely get through.

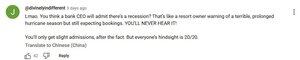

Interesting, the most liked comment under that interview video: Do you really think the bank CEOs will tell you that we are already in a recession? You will never hear that.

Actually, there was a similar comment under my video yesterday, and I want to share my thoughts. Based on my tracking of U.S. bank earnings reports over the years, along with my tracking of JPM, I believe Brian Moynihan is trustworthy.

You might have forgotten that in 2022, the CEO of JPM said, "An economic hurricane is coming," and in April 2023, he mentioned dark clouds gathering. But all along, the U.S. bank earnings reports have been telling me: consumer spending is very strong; growth is normalizing, so inflation will come down; if you ask me who I trust? Of course, I trust my friend Brian Moynihan.

43,03K

Johtavat

Rankkaus

Suosikit