Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The BTC+ vault recently launched by Solv Protocol is quite interesting, as it turns institutional-grade Bitcoin yield products into a one-click operation that retail investors can also participate in. After its launch on August 1, this vault offered a base yield rate of 5-6%, which is a pretty impressive figure in the current market environment. More importantly, it packages actual yield products from traditional financial giants like BlackRock's BUIDL fund and Hamilton Lane's SCOPE with on-chain credit and basis arbitrage DeFi strategies into one product, a mix that is quite rare in the industry.

Binance's choice of #Solv as the exclusive BTC fund manager for #Binance Earn is noteworthy. It's important to understand that centralized exchanges have always preferred to keep their core business in-house, so allowing a third party to manage funds indicates that Solv indeed has solid capabilities in custody compliance and yield infrastructure. The $25,000 SOLV token incentive from the BNB Chain Foundation is not just a giveaway; it is part of a $100 million grand plan, and such a level of ecosystem recognition is a substantial endorsement for early-stage projects.

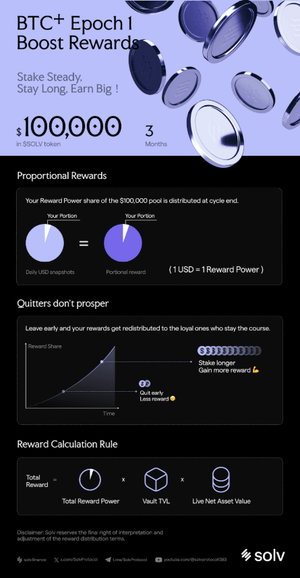

The design of the BTC+ vault is quite clever, using a time-weighted metric called "reward power" to distribute a $100,000 SOLV reward pool. Simply put, the longer you lock up your assets, the more you earn, which prevents opportunistic behavior while allowing long-term holders to benefit more. The operational aspect is also simple; there's no need to deal with cross-chain bridges, as you can stake native BTC directly, making it very user-friendly for newcomers.

From an architectural perspective, Solv is building a yield pipeline that spans CeFi, DeFi, and TradFi. On one side, it connects with trading giants like Binance, while on the other, it collaborates with traditional asset management institutions like BlackRock, all linked together by multi-chain vaults. This design allows Bitcoin to potentially reach both retail wallets and sovereign wealth funds for the first time, creating significant imaginative space. Especially as the Bitcoin ecosystem increasingly emphasizes actual yields, Solv's middleware, which retains decentralized characteristics while connecting to traditional yield products, could become an important infrastructure in the next cycle.

@SolvProtocol #BTCUnbound $SOLV

14,08K

Johtavat

Rankkaus

Suosikit