Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

There is a reason @Uniswap is tweeting out Unicorn animations instead of celebrating the launch of DEX trading to @coinbase users.

Uniswap Labs has profited millions of dollars from @base trading through their front end fee. Their moat has been trust in their front end and wallet app.

On the flip side, @AerodromeFi has distributed millions of dollars to $AERO lockers via smart contract design. Their moat is deep liquidity.

With Coinbase bringing the Defi Mullet to DEX trading on their front end, Uniswap's revenue stream gets bypassed, while Aerodrome's is fed through the integration.

Uniswap has to fight against every other front end that uses their pools for their fee cut, Aerodrome encourages as many front ends accessing liquidity as possible to feed their engine.

Built differently.

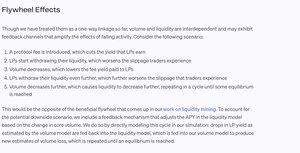

@rliriano @Uniswap @coinbase @base Fee switch just takes from LP's, making them less profitable, driving them to find higher yield pools, worsening trade execution, and lowering APR further.

21.9.2024

This could not be coming at a worse time for Uniswap as the token vests they've used to subsidize their costs and yields are ending.

They are faced with having to cut LP yields via the "Fee Switch" to sustain themselves at a moment where they are already struggling to compete.

151,6K

Johtavat

Rankkaus

Suosikit