Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Many people think that high traffic occurs when the market is good, but that's actually wrong. Traffic is higher when the market is down because everyone wants to find reasons through social media.

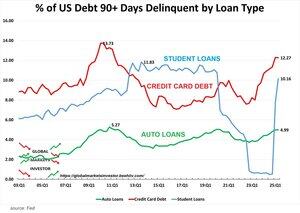

So creating panic can generate traffic. In April, I had an argument with someone because I believed he was creating panic. The chart below aims to show that the credit card 90-day delinquency rate is close to that of 2008, but if you flip a page back, you'll see that the 30-day delinquency rate has remained stable and has decreased for two consecutive quarters. In March and April, too many people were glorified for shorting early. There are even foreigners who speak Chinese; for example, there’s a guy named Ke Song who successfully predicted the decline in March and April, but he also said that the Federal Reserve would start QE in June and that the U.S. stock market wouldn't reach new highs. Looking at it from the present, all of that is wrong. So there are no gods in the market; everyone can be wrong. The U.S. stock market has long bull and short bear phases, so most of the time, one should have positions while considering risks rather than being in cash and thinking about risks.

10.8. klo 22.30

🚨US SERIOUS delinquencies are at CRISIS levels:

The share of credit card debt delinquent 90+ days hit 12.3% in Q2 2025, the highest in 14 YEARS.

At the same time, the share of student and auto loan serious delinquencies reached 10.2% and 5.0%, the highest in 15 and 5 years.

22,11K

Johtavat

Rankkaus

Suosikit