Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

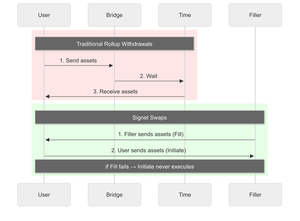

1/ traditional rollups impose constraints on capital through mandatory withdrawal delays and lockups

signet removes these constraints entirely

instant settlement

6.6.2025

1/ Signet's Settlement System: Capital velocity and market-based incentives.

Atomic bundle construction.

2/ complex verification periods are a design choice, not a requirement. markets provide instant swaps through economic incentives, not complicated proofs

3/ our OrderDetector is protocol-level enforcement of atomic cross-chain execution

- fill validation happens pre-execution

- conditional transactions enforce all-or-nothing semantics

- failed conditions erase themselves from history

this is deterministic.

4/ Permit2Batch enables single-signature auth for complex multi-token actions. SignetEthBundle wraps these into atomic cross-chain bundles:

- one user intent

- multiple cross-chain actions

- zero intermediate states

we've eliminated the complexity of cross-chain coordination

5/ filler infrastructure on Signet:

- aggregate_by_chain() groups orders by destination

- sign_fills() creates batched Permit2 authorizations

- sequence_transactions() enforces execution order

this is pragmatic design

6/ capital velocity matters

when funds can redeploy in seconds instead of days:

- intra-block arbitrage across chains

- dynamic inventory rebalancing

- continuous liquidity deployment

the constraint was never the tech, it was the intuition

7/ building on Signet is working with infrastructure that treats cross-chain atomicity as a first-class primitive

where traditional systems see efficiency in proofs, we see simplicity in markets

where others build labyrinths, we keep it lean

998

Johtavat

Rankkaus

Suosikit