Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Nik

Once wrote a book about magic internet money.

Gm ☕️

Oh look a weekly high that formed in the first 5 minutes of the weekly open

Don’t make me tap the sign…

Pretty light start to the week on the macro front but plenty of growth data into the back end, followed by Powell’s speech and Jackson Hole

Market Outlook will be available in a couple hours at @OstiumLabs 🫡

38,61K

Yo

Nik15.8. klo 01.56

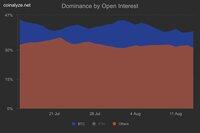

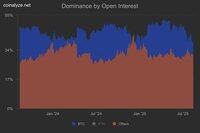

Chart 1 & 2 here just show that this past week hasn’t been particularly frothy from a derivs POV for alts vs BTC — nowhere near the crossover yet nor even the more recent small peaks

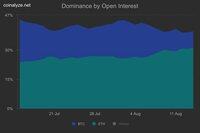

Chart 3 shows progress towards that ETH vs BTC OI crossover I mentioned a few days ago

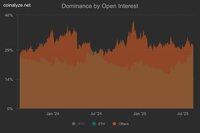

Chart 4 is the more interesting one and I wish we had more historical data — ETH vs OTHERS OI crossing over here for the third time since summer 2023 (see next tweet for price-action implications)

I word vomited some ideas around potential rotations over the coming weeks and this is one point of confluence for that playing out (

12,17K

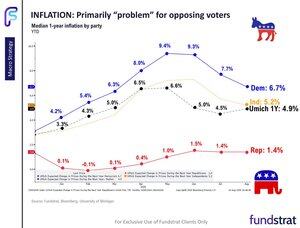

The most trash survey continues to be trash, quelle surprise

Thomas (Tom) Lee (not drummer) FSInsight.com15.8. klo 23.01

The latest U Mich 1-yr inflation expectations crept up to 4.9% from 4.4% last month.

But this is the odd thing:

➡️every single cohort, Dems, Independents, Republicans expect less inflation

➡️how does the total inflation line rise?

➡️maybe more "Dems" in the survey

Bottom line: highlighting why this survey is increasingly less reliable

PS: we know what has happened since 2022 --> buy the dip

6,54K

DXY already given up all of yesterday’s post-PPI gains

If Retail Sales comes in marginally lower than consensus I think yesterday’s print is entirely forgotten about and both DXY and 2-year yields move to fresh weekly lows but risk stays bid

At or marginally above consensus is still Goldilocks

Just don’t wanna see a super negative print and stoke the stagflation fears post-PPI and don’t think it’s likely we see a massive beat given CARTS data

Would be nice to see upside surprises in manufacturing data but who knows

9,31K

Chart 1 is just that Net % of Lenders Tightening Standards from previous tweets but inverted (up = looser lending standards) mapped vs ISM

Chart 2 adds in BTC (pink) and commodities (green) with ISM (purple) and lending (white)

Lending standards tend to bottom out marginally later than the manufacturing cycle peaks and commodities peak around the same time if not a little later than lending standards bottoming (and one can draw parallels with stuff like watches which also peak late with commodities)

10,34K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin