Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The 4-year cycles are coming to an end.

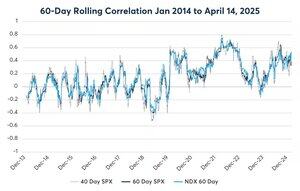

According to the 40-day rolling data, Bitcoin is in positive correlation with the broader equity markets (SPX/NDX) since Nov. 2023. This is one of its longest periods of alignment since the 2021–2023 run.

Before COVID, $BTC / equity correlations dipped into negative territory almost on a quarterly basis. That pattern is long gone now. Since 2019, the only two times correlation have been disrupted were during Luna and FTX implosions.

Main reasons driving positive correlation:

➤ Deeper integration with traditional finance, particularly major U.S. equity indices

➤ Less supply available to traders and market manipulators. In March 2020, 17.8% of BTC supply sat on exchanges; today, it’s roughly 11.3%

➤ Supply migration to long-term holders, including ETFs, governments, and treasury companies

Unless we get another blackswan, researchers expect correlations to stay above 0.50 in the coming years.

This means more stability for alts and BTCfi adoption.

Post dot-com era for crypto has started.

18,24K

Johtavat

Rankkaus

Suosikit