Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

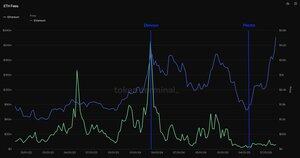

ETH is close to its ATH - yet the fees earned on Mainnet are at the same level as in May, when ETH’s price was more than 50% lower.

Two major upgrades, Dencun (March 2024) and Pectra (May-2025), slashed L1 costs. The result:

- Fee revenue fell from $100M+ weeks to low single-digit millions

- Price has decoupled from fee capture for the first time in years

- The L1 premium is now about settlement dominance, not expensive blockspace

- @ethereum traded the “scarcity” narrative for ecosystem scale & rollup adoption - which still hasn’t taken off meaningfully

This is a turning point and proof that a chain can rally without high L1 revenue, and a warning to those banking on “high fees = high token price” as a universal rule.

Data: @tokenterminal

5,04K

Johtavat

Rankkaus

Suosikit