Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

seneca

@nounsdao

at some point in the next decade or so, when millennials matter (more), the political upside of doing something about student loans will be too big not to run on it

Boring_Business19.8. klo 03.27

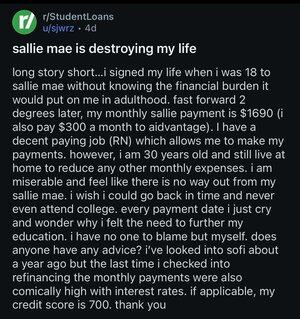

Student loans are doing unrepairable damage to the financial future of the younger generation

Not proposing that we use taxpayer money to bail out these folks, but what is the realistic solution here?

Some of these people will never earn a wage that makes these loans payable

746

Wow. Build your own software through touch. Played with it for a few mins and can see the future here. Go try it!

Serious prop to whoever is behind this. This is beautifully executed.

Gizmo19.8. klo 03.18

Meet Gizmo: a new way to make playful, personal software—right from your phone.

No code. No desktop. Just your camera, your fingers, and a good idea.

[1/7]

1,99K

Under 35 year olds need to stop buying Starbucks asap

unusual_whales15.8. klo 00.57

"There are now more homebuyers over age 70 than under 35," per FORTUNE.

227

Epic. Congratulations to the Atrium team on crushing it with one of the biggest crypto native IPs out there: Quack and Lola! ⌐◧-◧

Atrium15.8. klo 12.21

We're proud to be teaming up with Visional Pop to push Quack and Lola ⌐◨-◨ into being a major global entertainment brand.

The collaboration will focus on new multi-platform content, consumer products, and digital experiences. 🌟

1,34K

Good thought process to exercise. Revisit sizing by reviewing conviction.

Kun15.8. klo 15.54

If you dont have a process and you bought some stuff awhile ago and you arent sure if you are holding for just emotional bias now or because you should

Just ask yourself if you would rebuy the position today at its market value

Now if not that doesnt necessarily mean you should sell it all

It just makes you ask questions of ok why wouldnt I or why I would - it considers if thesis is in tact or not, if sizing is correct, whats changed etc

Sometimes you may still hold anyway because you bought early and now have a buffer to let it play out etc

It helps for both positions you are down alot on and positions you are up alot on - as it separates the sunk cost fallacy and price confirmation bias to your thinking

718

The meme saga continues: initiated by retail investors; they have managed to force $open CEO to resign.

This ain’t your grandpa’s stonk market!

Carrie Wheeler15.8. klo 21.03

Today, I am stepping down as CEO of Opendoor.

When the Board of Directors asked me to take on this role at the end of 2022, the company was in crisis. The real estate market was punishing, the business needed a reset, and the path forward was uncertain. My mandate was clear: stabilize the company and do what was necessary to survive. Of course, I said yes – because I believed in Opendoor.

It wasn’t easy, and it wasn’t about glamorous headlines, but we stopped the bleeding. We restructured the business, rebuilt an exceptional leadership team, set a bold vision for long-term value creation, and reshaped the company for the future – all against the backdrop of one of the toughest real estate markets on record. We went from $1 billion in losses when I took over, to announcing our first quarter of positive EBITDA in three years this past quarter. We architected a new strategy and moved from being a single-product operator to a multi-product platform for consumers and agents alike. And all the while, we continued to deliver for customers with an NPS of 80. I’m proud of the transformation we’ve driven together.

To everyone who helped steady this ship: thank you. This was a turnaround in every sense of the word. The last weeks of intense outside interest in Opendoor have come at a time when the company needs to stay focused and charging ahead. I believe the best thing I can do for Opendoor now is to accelerate my succession plans that I shared with the Board mid-year and make room for new leadership to take the reins.

I am pleased that the leadership team will continue to execute on the vision and strategy that we put in place. I am deeply grateful for the incredible team at Opendoor for their passion for reinventing the real estate business. The foundation is stronger, the vision is sharper, and the business is ready for what comes next. I’m closing this chapter with pride, clarity and gratitude.

1,15K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin