Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

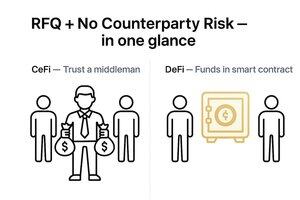

Last week @DanDeFiEd made a post about Rysk’s RFQ model and “no counterparty risk.”

Some of you got it immediately… some didn’t

Let me break it down in plain English — and with an analogy you’ll actually remember 👇

First — what’s an RFQ?

It stands for Request For Quote.

Think of it like walking up to a market stall and asking:

“How much for this basket of mangoes?”

The seller gives you a price before you agree to buy.

In Rysk’s case, the “basket” is an options trade.

You see the premium (your payout if conditions are met) upfront — no surprises later.

Now the “no counterparty risk” part.

In CeFi, you trust a middleman to hold both sides’ money until the trade is done. If they vanish or default, you’re screwed.

On Rysk, both sides’ funds go straight into a smart contract on-chain.

That contract is the vault — it won’t release funds unless the trade conditions are met.

No trust games. No “hope they pay me.” The code enforces it.

It’s like buying from a vending machine instead of a random guy on the street.

You put your money in, the machine holds it, and you either get your snack or your money back — no human middleman to flake on you.

That’s the magic of DeFi + Rysk’s RFQ model:

•You know your premium before you click “trade”

•Funds are locked in a smart contract

•The system settles automatically — no counterparty risk

Simple, secure, transparent.

8.8. klo 22.14

Lot of people ask who’s the counterparty on Rysk.

It's an RFQ. Users see the premium upfront before the trade.

Settles on-chain. Funds in smart contracts.

No counterparty risk. That’s literally the point of DeFi.

Still curious why the counterparty matters so much.

1,05K

Johtavat

Rankkaus

Suosikit