Populaire onderwerpen

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mijn 2 cent: Mensen zijn gefascineerd door zwarte dozen die hen passief geld opleveren, denk aan FX-handelsbots, pokerspellen, verkoop signalen of sociale handel - niets hiervan werkt echt, maar de meeste mensen zouden er nog steeds voor betalen in plaats van hun eigen ideeën en strategieën te vormen.

Iedereen wil het handelen/investeren delegeren aan een slimme robot die "passief inkomen" genereert - dit zal niet goed werken voor competitieve nul-som handel, omdat het zal worden opgegeten door professionals met hun eigen modellen, maar het kan goed werken met passief investeren.

Nadat de eerste hobbels zijn overwonnen en LLM's zijn RLHFed voor deze use case, zullen ze in ieder geval veel beter zijn in het volgen van solide risicobeheerprincipes dan mensen.

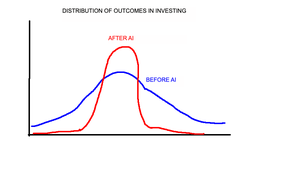

We zullen beide uiteinden zien instorten - minder mensen zullen volledig falen, maar ook niet beter presteren.

Mensen zullen zich dan zorgen maken over de "leeftijd van de midcurve" in investeren, aangezien praktisch iedereen dezelfde modellen gebruikt en hetzelfde doet, maar dan realiseer je je dat we daar eigenlijk al zijn met passief investeren en ETF's, het zal gewoon verergerd en een beetje verdraaid worden.

Terwijl passief investeren nu een inherente bias heeft naar grote winnaars (de manier waarop indices zijn gewogen), zal AI-gedreven passief investeren het speelveld een beetje nivelleren door niet zo bevooroordeeld te zijn tegen kleinere aandelen.

Kortere tijdsframes en bekende segmenten zullen volledig worden gedomineerd door AI-financiële adviseurs, maar op lange tijdsframes en in meer idiosyncratische velden zullen mensen nog steeds in staat zijn om een voorsprong te behouden.

30 jul 2025

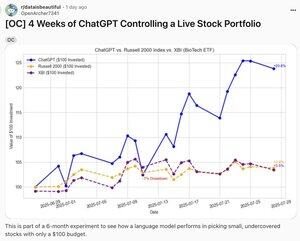

someone on reddit let ChatGPT manage a $100 stock portfolio for four weeks and beat the market by 23%.

here are 14 things it means for you, markets and the future of finance:

1. there will be a massive market crash caused by too many AIs making the same trades. when millions of ChatGPT instances start following similar logic, you get dangerous herding behavior. the reddit user asked to buy microcaps and it ONLY bought biotech. imagine this at scale.

2. companies will start optimizing press releases for AI readers, not humans. the businesses that write in "AI-parseable" language will get disproportionate algorithmic attention and investment.

3. we'll see the rise of "AI investment clubs" where people pool money and let collective AI strategies compete. it'll be like fantasy football but with real money and ChatGPT as your quarterback.

4. financial advisors will become "AI prompt engineers." instead of picking stocks, they'll craft the perfect instructions for AI systems and charge clients for their prompting expertise.

5. day trading will be completely dominated by AI within 18 months. humans won't be able to compete with AI that can process earnings calls, news, and social sentiment in real-time.

6. every retail investor will have an AI trading assistant by 2027. not managing their money directly, but whispering suggestions in their ear based on news they'd never read themselves.

7. investment newsletters will pivot to selling "winning prompts" instead of stock picks. why give you fish when they can sell you the AI fishing rod?

8. someone will build a "social network for AI trading strategies." think github for investment prompts where successful strategies get forked and improved by the community. a16z prob funds it

9. the SEC will create new regulations around "algorithmic investment advice." they'll scramble to figure out who's liable when your ChatGPT loses your retirement savings.

10. google searches for basic financial terms will plummet by 50%. why google "what is a P/E ratio" when you can ask your AI assistant to explain it while analyzing your portfolio?

11. the phrase "my AI beat your AI" will become the new "my dad can beat up your dad." AI performance bragging becomes a social status symbol.

12. your bank will offer "AI portfolio management" as a free checking account feature. basic AI investing becomes as common as mobile deposits.

13. AI will create the first "algorithmic insider trading" scandal. when AI can predict earnings better than executives, the definition of insider information gets blurry.

14. the stock market will have its first "AI flash crash" caused by recursive feedback loops. millions of AI systems reacting to each other's trades in milliseconds.

the reddit post went viral because it feels like a glimpse into a world where everyone has access to institutional-level analysis. but really, it's showing us how quickly we're willing to hand over decision-making to systems we don't understand.

maybe that's not entirely bad though. most people are terrible at investing anyway, they buy high, sell low, and let emotions drive every decision. if AI can remove the emotional component and stick to data-driven

strategies, maybe we'll all end up better off. And plus financial advisors charging ~1% AUM has been unchallenged for too long.

What do you think?

het is nog te bezien of het systeemrisico op de markten hoger of lager zal zijn dan nu

Argument voor: als we aannemen dat alle modellen hetzelfde zullen doen, zal elke voor de hand liggende handel overbevolkt zijn, wat de volatiliteit en systeemschokken verhoogt

Argument tegen: iedereen kan zijn AI een beetje anders aansteken volgens zijn eigen behoeften, AIs zullen in staat zijn om meer gediversifieerde portefeuilles van minder bekende aandelen te volgen en te beheren, terwijl de meeste investeerders nu geconcentreerd zijn in een paar grote namen en ETF's, zal AI in staat zijn om een op maat gemaakte ETF aan iedereen te leveren, waardoor de allocaties over een breder scala van activa worden verspreid

Het is veilig om te zeggen dat geen van de beschikbare modellen de markt zal verslaan zonder significante betrokkenheid van de besluitvorming van de gebruiker

20,55K

Boven

Positie

Favorieten