Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

P/F (Price to fees) ratio shows how much you pay per dollar of protocol revenue.

Lower = potentially undervalued

> $SYRUP: $639M FDV ÷ $12.45M fees = 51.3 P/F

> $AAVE: $4.86B FDV ÷ $737.71M fees = 6.6 P/F

You're paying $51 for each $1 of Maple's revenue vs $6.60 for Aave's

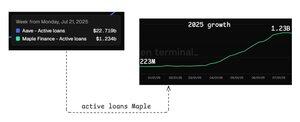

SEE @aave generates 60x more fees than @maplefinance but trades at only 7.6x the valuation. By pure fundamentals, Aave looks undervalued.

But Maple's targeting institutional lending & smaller market, bigger growth potential. Their 5.5x TVL growth since April explains the premium.

But both are VALUE plays.

28.7.2025

Maple Finance ($SYRUP) is on a very bullish trajectory

In first 3 week of July

- Aave's earning ~ 1.3M

- Maple's earning ~ 440K

The loanbook size difference in aave and maple is around 18 times whereas the earning difference is only 3 times

- TVL growth has been massive in 2025

- Mcap has also increased around 5.5x from April

7,19K

Johtavat

Rankkaus

Suosikit