Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Cato_KT

August 21 Crypto Comprehensive Daily Report

Introduction:

The minutes from the Federal Reserve's July meeting did not trigger market volatility, and the market remains "cautious" ahead of Powell's speech!

The US-EU trade agreement has been reached, once again altering the global trade landscape and the geopolitical dynamics of Russia and Ukraine!

#Bitcoin's rebound is weak; will the bearish sentiment clear ahead of Powell's speech?

Cato_KT20.8. klo 22.58

August 20 Crypto Comprehensive Daily Report

Introduction:

This week’s "calm" is about to be broken, as tonight's monetary policy minutes and the speech by the Federal Reserve governor serve as the "appetizer" for the week, awaiting Powell's speech this weekend.

Tech stocks are changing hands rapidly, facing Powell's speech this weekend, and risk markets may seek safety in advance!

#Bitcoin support turns into resistance, when will we see a signal to stop the decline?

6,96K

It's ridiculous that the official account is actively suppressing market sentiment, they just don't want the #OKX coin price to have too much of a bubble.

But unfortunately, the O guards are a bit crazy~

OKX中文12 tuntia sitten

OKB has been quite volatile recently. Please remain calm and rational, and do not blindly chase highs. It is advisable to manage your positions reasonably, ensure proper fund management, prioritize risk, and move forward steadily to go further.

4,47K

At 5 AM on August 20th, I wrote the previous text, when the price of #OKB was 122,

I was hesitating about when to buy on a dip,

But I didn't wait for the dip, and instead, I saw a breakout to 200.

I just slapped myself twice,

"Mocking" @CryptoPainter_X, who was also waiting for a dip, and now it's at 224. We're both unfortunate souls who missed the ride.

Congratulations to @Phyrex_Ni for making a killing~ It makes me feel so itchy~

@Haiteng_okx boss, give me some insider info, how high can it go?

Cato_KT20.8. klo 05.53

I took a look at #OKB before bed. To be honest, there’s a reason why it’s strong, and after this "update," most holders are adopting a long-term mindset, so it’s hard to see any sell-offs in the short term.

As for the project team, @okxchinese has its own profit-making methods, so they definitely won’t cash out and crash the market in the short term. This leads to a really stable market, completely counter to the trend, transforming from a previous "stablecoin" to a high-level "stablecoin."

It’s important to note that this is still in the stage where empowerment hasn’t fully started. Once it truly begins to build and empower, with a significant reduction in total supply + accelerated consumption, to be honest, I’m a bit tempted.

I feel ashamed to say that I was quite optimistic about OKB in 2023, but later I really couldn’t hold on, and I didn’t expect it to reach this point. I guess my understanding was too shallow!

11,03K

It should be added that when I previously discussed the issue of the "North American Economic Belt," I mentioned that once Europe compromises, it will become the main dumping ground for U.S. production capacity in the future.

Europe's compromise means that Trump has solved the market demand issue, and now he only needs to address the market supply issue.

From another perspective, if there is demand in the market, it will nurture a surge in production.

Of course, the premise is that there should be no competitors on the supply side, and China happens to be a stronger competitor. Therefore, in the future, the U.S. will inevitably find ways to cut off China's industrial output chain.

This is an unavoidable contradiction.

Cato_KT14 tuntia sitten

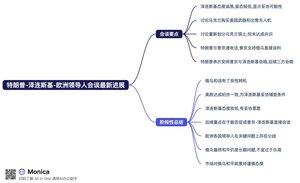

The US-EU trade agreement has been reached, marking a milestone trade deal.

According to the latest news, it has been confirmed that the US and EU have reached a trade agreement, with the specifics as follows:

1. A 15% base tariff: The US will impose a 15% tariff on EU goods (such as automobiles, pharmaceuticals, and semiconductors), significantly lower than the previous 30%.

2. EU's reciprocal commitments: The EU promises to expand its purchases from the US over the next few years and to invest heavily in the US, including $750 billion for US energy and over $600 billion in strategic investments in US industries, along with substantial military procurement.

3. The issue of automobile tariffs remains unresolved: The US maintains a high tariff of 27.5% on EU auto parts, but has stated that if the EU can pass relevant legislation to address US industrial product taxes, it will lower the auto tariff to 15%, hoping to achieve this in the coming weeks.

4. In this trade agreement, both sides will also cooperate to promote digital trade, supply chain security, export controls, and investment reviews.

Assessment:

Overall, reaching a tariff agreement with Europe is a significant resolution to a major challenge faced by Trump. I have always emphasized that there are two major hurdles for Trump in tariff trade: one is the EU, and the other is China.

Now, with the EU's tariff issue resolved, future trade pressures will naturally focus on China, and the next 90 days of tariff suspension are likely to be difficult to negotiate.

On the other hand, the US-EU trade agreement also has a potential condition: low tariffs in exchange for European countries' compromises on the Ukraine issue.

In the past, Ukraine could maintain its resistance against Russia largely due to the support from various European countries. Now that the supporters are gone, Ukraine's ability to continue the war has significantly diminished.

Furthermore, the US and EU reaching a trade agreement indicates that they have preliminarily reached a consensus on many issues. Earlier this week, after the "Tze meeting," I mentioned that to pressure Ukraine into a compromise, it is essential for the US and EU to first maintain unity and then jointly pressure Ukraine.

Therefore, the US-EU trade agreement also implies that the Russia-Ukraine negotiation process may accelerate, making it easier for Zelensky to compromise, marking a significant geopolitical turning point!

5,39K

The US-EU trade agreement has been reached, marking a milestone trade deal.

According to the latest news, it has been confirmed that the US and EU have reached a trade agreement, with the specifics as follows:

1. A 15% base tariff: The US will impose a 15% tariff on EU goods (such as automobiles, pharmaceuticals, and semiconductors), significantly lower than the previous 30%.

2. EU's reciprocal commitments: The EU promises to expand its purchases from the US over the next few years and to invest heavily in the US, including $750 billion for US energy and over $600 billion in strategic investments in US industries, along with substantial military procurement.

3. The issue of automobile tariffs remains unresolved: The US maintains a high tariff of 27.5% on EU auto parts, but has stated that if the EU can pass relevant legislation to address US industrial product taxes, it will lower the auto tariff to 15%, hoping to achieve this in the coming weeks.

4. In this trade agreement, both sides will also cooperate to promote digital trade, supply chain security, export controls, and investment reviews.

Assessment:

Overall, reaching a tariff agreement with Europe is a significant resolution to a major challenge faced by Trump. I have always emphasized that there are two major hurdles for Trump in tariff trade: one is the EU, and the other is China.

Now, with the EU's tariff issue resolved, future trade pressures will naturally focus on China, and the next 90 days of tariff suspension are likely to be difficult to negotiate.

On the other hand, the US-EU trade agreement also has a potential condition: low tariffs in exchange for European countries' compromises on the Ukraine issue.

In the past, Ukraine could maintain its resistance against Russia largely due to the support from various European countries. Now that the supporters are gone, Ukraine's ability to continue the war has significantly diminished.

Furthermore, the US and EU reaching a trade agreement indicates that they have preliminarily reached a consensus on many issues. Earlier this week, after the "Tze meeting," I mentioned that to pressure Ukraine into a compromise, it is essential for the US and EU to first maintain unity and then jointly pressure Ukraine.

Therefore, the US-EU trade agreement also implies that the Russia-Ukraine negotiation process may accelerate, making it easier for Zelensky to compromise, marking a significant geopolitical turning point!

Cato_KT19.8. klo 19.18

Latest updates on the "Tezhe Conference": Is there a significant turning point for peace between Russia and Ukraine?

Finally finished summarizing the discussions between Trump, Zelensky, and European leaders up to this point.

1. The meeting officially began with Zelensky thanking Trump eight times. Zelensky was dressed in a suit, and overall, his attitude appeared sincere and humble, indicating a potential for compromise.

2. Zelensky stated that the talks included Ukraine purchasing $90 billion worth of U.S. weapons through European funding as part of national security guarantees. Another part will involve the U.S. purchasing some drones manufactured in Ukraine, with the agreement expected to be finalized within the next week or ten days.

3. Zelensky mentioned that he and Trump displayed a map showing Russian-occupied Ukrainian territories in the office and had a lengthy discussion about it, while NATO Secretary General Stoltenberg stated that the two sides did not discuss redrawing Ukrainian borders.

4. During the talks, Trump interrupted the meeting to have a 40-minute phone conversation with Putin. A Russian foreign policy aide indicated that Trump conveyed the details of his discussions with European leaders to Putin, who expressed support for direct negotiations between the Russian and Ukrainian delegations.

5. Trump publicly stated on social media that he has begun arranging a meeting between Putin and Zelensky, and after the bilateral meeting, he will initiate a trilateral meeting.

6. The German Chancellor stated that a ceasefire is necessary before peace, but Trump disagreed, believing that a ceasefire is not a prerequisite. The German Chancellor mentioned that a bilateral meeting between Russia and Ukraine will take place within two weeks.

7. Before the "Tezhe Conference," Trump mentioned at a press conference that he does not rule out sending U.S. peacekeeping troops to Ukraine.

8. Some media reported that Putin has begun discussing Ukraine's security issues with European leaders.

Summary:

1. Currently, it seems that the Russia-Ukraine peace talks have made a positive turn.

2. In my tweet yesterday, I also mentioned that the premise for pressuring Zelensky is that the U.S. and Europe must reach a consensus. While a complete consensus has not yet been achieved, there seems to be preliminary agreement on moving towards peace between Russia and Ukraine.

3. Prerequisites include the U.S. and Europe providing security guarantees to Ukraine while laying the groundwork for Zelensky to make compromises, specifically, to cede territory in exchange for peace.

4. Zelensky's attitude during this meeting with Trump has significantly lowered, indicating he is under immense pressure and is likely prepared to compromise, provided that the U.S. and Europe can protect him.

5. However, the focus will still be on whether a direct meeting between Putin and Zelensky can be facilitated. Currently, Putin's stance remains that negotiations should be conducted by delegations, while Trump aims to facilitate a final trilateral meeting involving the U.S., Russia, and Ukraine, or even a quadrilateral meeting with the U.S., Russia, Europe, and Ukraine, which still presents certain challenges.

6. Trump's rebuttal of the NATO Secretary General's viewpoint indicates a degree of compromise and concession in Trump's stance towards Russia, which is a positive development. However, whether Europe can fully compromise on the Russia-Ukraine issue remains a challenge. While it appears that a consensus has been reached, Europe is typically characterized by a loose organization, with national leaders having their own agendas, requiring significant time for discussions on key issues.

7. Achieving peace between Russia and Ukraine remains a long-term issue. Although there is a more optimistic trend currently, we should not be overly optimistic in the short term; we cannot expect that more than three years of war can be resolved overnight.

8. Putin's attitude and Russia's demands, especially regarding territorial issues, remain unclear. If disputes arise over territorial matters, reaching a final agreement will still be difficult.

9. Looking at the trend of gold, the market does not seem to have high expectations for peace between Russia and Ukraine, so whether the negotiations will ultimately succeed still requires more information and time.

10,47K

Powell's timing for the Jackson Hole speech has been adjusted; I previously thought it was in the evening US time, but now it seems it's in the morning US time.

So, referring to the time difference of 12/14, it basically means it's in the evening Beijing time.

Looks like we're going to experience market fluctuations on Friday, so everyone buckle up!

TraderS | 缺德道人21 tuntia sitten

Use this schedule to make an order against the 4h line of the flatbread, be steady

10,82K

August 20 Crypto Comprehensive Daily Report

Introduction:

This week’s "calm" is about to be broken, as tonight's monetary policy minutes and the speech by the Federal Reserve governor serve as the "appetizer" for the week, awaiting Powell's speech this weekend.

Tech stocks are changing hands rapidly, facing Powell's speech this weekend, and risk markets may seek safety in advance!

#Bitcoin support turns into resistance, when will we see a signal to stop the decline?

Cato_KT19.8. klo 22.49

August 19 Crypto Comprehensive Daily Report

Introduction:

Good news from the "Teze Conference" suggests a potential optimistic shift in the Russia-Ukraine geopolitical situation, but the market remains cautiously optimistic.

#Bitcoin is initially testing key support, and the market continues to maintain a low-range fluctuation, enduring the "boring" times!

20,56K

This week's macro event summary details the timing of Powell's speech, with several points to note:

1. Tonight at 2 AM, strictly speaking, it is the early morning of August 21, when the Federal Reserve will release the minutes from the July meeting, and several board members will speak after the meeting.

2. This week, Powell's "Jackson Hole" speech lasts for three days, from August 21 to August 23 in U.S. time. The meeting location is based on Mountain Time (14-hour difference), so in Beijing time, it will be from August 22 to 24, which is from Friday to Sunday.

3. The exact timing of the meeting is uncertain, but it will likely be in the evening U.S. time. Based on the time difference, August 21 evening + 14 hours basically translates to the morning of August 22 in Beijing time. The earliest we can hear Powell speak will be Friday morning.

4. The first day is the opening ceremony, where everyone will greet each other, but the focus is on the second day's meeting, where Powell will express his views on the economy and the Federal Reserve's interest rate policy, so the key time is Saturday morning.

5. Based on this timeline, it looks like this weekend will be quite busy!

Cato_KT18.8. klo 10.54

August 18 - August 22 Macro Event Summary: This Week's "Simple" Talk, "Two Macros, One Geopolitics"

This week's macro data is relatively simple, with only two important macro speeches to focus on, as well as one geopolitical meeting; these three will be the main "anchors" for the market this week.

On Monday, August 18,

Time uncertain, Trump meets with Zelensky at the White House in Washington.

On Thursday, August 21,

02:00 The Federal Reserve releases the minutes of the monetary policy meeting.

In the evening (time uncertain), Powell will speak at the Jackson Hole Global Central Bank Annual Meeting.

Interpretation:

1. Zelensky's visit to Washington to meet with Trump will be accompanied by NATO Secretary General and the President of Finland to discuss the theme of communicating a ceasefire and peace framework between Russia and Ukraine.

After last Friday's meeting between the US and Russia in Alaska, Putin's side has already clearly proposed a preliminary framework for a ceasefire, with the main themes still being territorial concessions and Ukraine's non-NATO membership.

Trump is responsible for communicating with Zelensky, and if all goes well, he will announce the facilitation of a subsequent meeting between Putin and Zelensky.

Of course, I personally do not have high hopes for this; while not joining NATO is negotiable, the territorial issue is something Zelensky cannot concede lightly.

2. The Federal Reserve will release the minutes from the July meeting, and several Fed governors will speak afterward, guiding the fluctuations in expectations for a rate cut in September; currently, a rate cut in September remains a high probability event.

3. Powell will speak at the Jackson Hole Global Central Bank Annual Meeting, with the time uncertain. The original plan was for the evening of August 21 in US time, and the meeting is held according to Mountain Time, which has a 14-hour time difference with Beijing time, so the approximate time will be on the morning of August 22 in Beijing time.

Additionally, this meeting's speeches are divided over three days; the first day is the opening ceremony, focusing on the global monetary policy direction and other important data releases, but Powell's speech will not be extensive.

The key date is August 22, which is Saturday, August 23 in Beijing time, when Powell will deliver a speech analyzing the economic outlook and the Fed's policy framework. This speech will have a significant impact on the probability of a rate cut in September.

The market's focus is primarily on how likely a rate cut in September is, followed by the magnitude of the rate cut in 2025 and the pace of policy easing. If everything is optimistic, the market is more concerned about how much of a cut can be achieved in the first rate cut of the year in September.

Personal Analysis:

Bank of America’s Hartnett stated that if Powell's speech is dovish, it may trigger a decline in global stock markets, mainly due to the "Sell the news" factor. If Powell is dovish, it essentially locks in the highest probability of a rate cut in September.

I feel that if being dovish is a "Sell the news" scenario, then hawkish risks will also negatively impact the market.

The entire situation seems like a "turtle poking its head out"; whether it sticks its head out or retracts, it’s still a knife.

Final Assessment:

This week is a relatively "vacuum period" for macro data, with the market's focus on the speeches of Fed governors and Powell. Since Powell's key speech is on Saturday, most of this week may be a "boring" time.

The market maintains a relatively cautious attitude, stabilizing and oscillating, with the final emotional outburst still waiting for Powell's speech to conclude and determine the direction of interest rates in September.

As for #Bitcoin, if most of this week is characterized by slight oscillations, it is not friendly for the current relatively high position, and overall liquidity this week is likely to be in a low phase.

18,98K

Ten years is not just about changes in assets and finance, but also about the transformation of the economy.

First and foremost, this is an important stage in China's economic transformation. In the past, it was about right and wrong; whether the transformation is successful is still a question mark.

However, subjectively, I believe it is optimistic. After flipping through posts from September 30 of last year, it wasn't easy to find on Twitter, so I could only screenshot my own Weibo records.

At this time last year, it seems not many people were optimistic, right?

So, ten years can change the economy and change the future, but it seems a bit difficult to change the "soft knee problem."

No worries, there is still plenty of time!

Engage in discussions and learning with rational people, and avoid too much "feudal superstition" and jumping around.

qinbafrank19.8. klo 18.29

The major A-shares index is quickly returning to where it was ten years ago, and housing prices have also reverted to ten years ago. Essentially, the path of wealth accumulation has undergone a significant transfer and change without us even realizing it.

9,62K

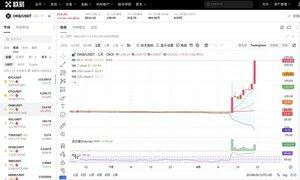

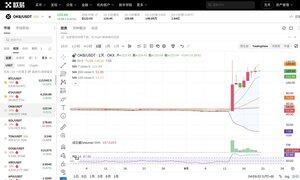

#Bitcoin The hourly-level signals indicating a stop in the downtrend that appeared in the early morning have been broken again, followed by new short-term stop signals.

When stop signals appear consecutively and are broken multiple times, it indicates that the short-term trend for this week is still predominantly downward, and the macro sentiment is not very optimistic.

At this point, it is advisable not to blindly go long; it is still necessary to wait for a key support test, and on the macro side, we need to wait for some important events to unfold.

Currently, the hourly-level stop signals are still not clear enough. Personally, I believe we should wait for a long candlestick on the daily chart before making a judgment.

The continuous appearance of "false" stop signals at the hourly level indicates that market sentiment is not yet completely clear. The short-term sentiment in the buy and sell orders is not very evident.

We should wait for Powell's speech this week to conclude, which will clear all the "negative" sentiments from this week, and then activate a large amount of buying, forming a longer "stop" trend on the daily chart, which would likely signal the end of this week's short-term downtrend.

For the short-term rebound, we should look at the breakthrough of the two consecutive resistance levels at 113,800 and 114,700. If the first resistance cannot be broken, it indicates a weak rebound, and the hourly-level stop signals are likely to be broken again!

Cato_KT20.8. klo 05.30

#Bitcoin Although there are short-term signs of a bottoming out on the 1-hour and 4-hour charts, the overall trend remains weak.

Currently, we can only look for a rebound, and we cannot confirm a bottoming signal on the daily chart. Pay attention to the resistance level at 114,700; it was previously support, and now that it has been effectively broken, it becomes a resistance level.

Additionally, the 4-hour MA7 has also reached this position. In the short term, until tomorrow morning, this is considered a short-term double resistance level, which will put significant pressure on the price rebound.

I believe that going long and bottom-fishing is not very suitable at this time. Personally, I would prefer to wait for a test of the key support before making any decisions. The next support is around 111,300.

Furthermore, on the macro front, I am also waiting for Mr. Powell to finish speaking before making any judgments.

19,7K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin