Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Prediction markets leak ≈ $40 M/yr in arbitrage

Here’s the data 👇

s/o @OSGbyte

1️⃣ The dataset

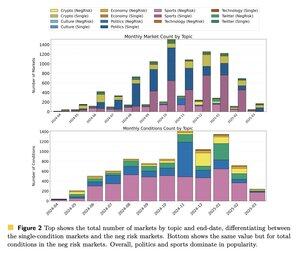

They scraped Polymarket (Apr ’24 → Apr ’25): 7 051 single-condition & 662 multi-outcome markets showed at least one window.

2️⃣ Two flavors of edge

• Market-rebalancing = fixing bad odds inside one market

• Combinatorial = exploiting logical links across markets

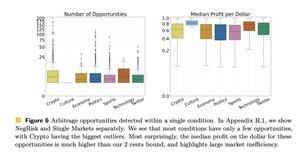

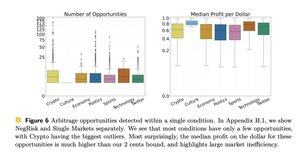

See screenshot for breakdown by market category

3️⃣ Realized gains

On-chain profit actually captured: $39.6 M: low-risk dollars left on the table.

4️⃣ Where the money was

• Politics = biggest single trades

• Sports = most frequent mis-pricings

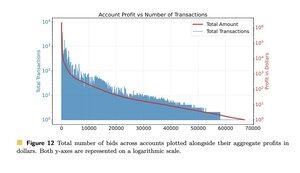

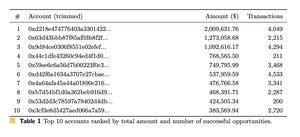

5️⃣ Who exploited it

A handful of bot wallets ruled: top 10 took > $8 M; one address alone ≈ $2 M.

6️⃣ Why inefficiency persists

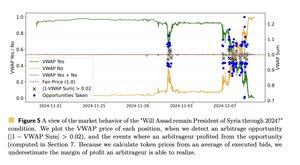

Polymarket’s hybrid CLOB isn’t atomic: fills can slip, so only spreads ≥ 5 ¢ are “risk-free.”

See example in screenshot with the question "Will Assad remain President of Syria through 2024"

7️⃣ Fixes & design ideas

- Clearer market-creation rules + batch auctions could tighten prices without killing liquidity.

- cross platform arbitrage across multiple prediction markets

Bottom line

Prediction markets are not perfectly efficient; vigilant traders (or bots) can still farm mispricings at scale.

Next election cycle will be even juicier.

3,73K

Johtavat

Rankkaus

Suosikit