Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Remarkable how every time you get a correction from new highs so many people start to fret about the cycle top. Over and over again.

Some thoughts on the market:

- This indeed is not early in the move, bitcoin is already 7x from the 2022 lows, and much of the move recently is driven by Tradfi's financial engineering via crypto treasury companies

- If concerned about the top, then sell/de-risk, as otherwise you are more likely to sell the bottom on the next move lower

- The concept of a 4 year cycle in 2025 is misplaced; can argue the 4 year cycle died 2 cycles ago, and 2021 was a coincidence, as it was macro driven

- Two things were very different in 2021:

a) BTC did go vertical on wild froth and leverage (a defining feature of that market was uncollateralized borrowing), and

b) the cycle ended not because of BTC or the halving but due to the FED going ultra-hawkish in January 2022

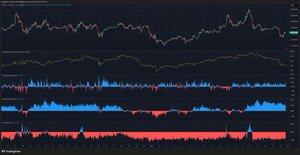

- As I wrote a couple of weeks ago (when I called the bottom at the bottom), I see August 2024 as a good template for August 2025; now look at the chart for August 2024

- I have a high degree of confidence this cycle is not over because I am expecting changes in the Fed to bring on considerably more dovish monetary policy, which is not priced in at the moment; this would start to get priced in once Trump announces his nominee to replace Powell

- In the immediate term, Powell is speaking at Jackson Hole (JH) on Friday, and I lean slightly bearish into it as a hawkish speech (to reduce the odds of a September cut) makes sense, for the Fed to retain optionality and not let the market push itself into a corner

- The Fed did flip more dovish on average post payrolls two weeks ago

- I still believe the Fed will cut in September

- The September FOMC is the next big trend defining event, and we are still 4 weeks, one speech (JH), and 4 data points away from it (PCE, NFP, CPI, PPI)

- BTC is having a very hard time going up sans leverage without triggers and is now sitting precisely at its trendline from the April lows

- Futures basis, a metric for froth in the market, dropped considerably in the last few days for both BTC and ETH

- Zoom out and we can see BTC is trading more like a stock now: low vol, slow ascent; the July breakout was different, much less of a step function than would have been the case in the pre-ETFs era

- Bull markets don't end because of valuations or over-extension, the end needs a major trigger

116,91K

Johtavat

Rankkaus

Suosikit