Populære emner

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

What are the risks of DeFi lending?

A quick + dirty VaR-style analysis on @ethena_labs , @aave , @skyecosystem and @multiplifi returns.

We don't think anyone has published risk metrics for DeFi rates.

Hopefully this is a step towards that:

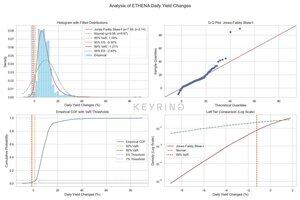

Let’s start with @ethena_labs ($sUSDe)

17-Jun-25 Rate: 3.21%

📉 99% percentile = -1.77%

📉 99% ES = -3.36%

🧠 Fat-tailed, asymmetric distribution

Translation?

There is some risk on the downside if those funding start flipping. Maybe due to huge AUM it's hard to be nimble? The massive upside tails skew the risk profile in your favour. You can see why this is one of the most popular positions in DeFi and they have an exceptional track.

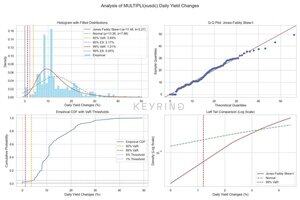

Then there's @multiplifi (xUSDC)

17-Jun-25 Rate: 5.21%

📉 99% percentile = 1.21%

📉 99% ES = 0.05%

@multiplifi seems to have exceptional risk adjusted yield.

Possibly boosted by low fee structure and forfeiture of treasury profits. Smaller AUM of $70m means low slippage: more ops for yield.

@multiplifi seems to have the best statistics we've seen.

Very impressive.

10,23K

Topp

Rangering

Favoritter