Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The main reason for the market adjustment is the PPI data triggering inflation concerns. To reverse this trend, we need to look at two aspects; otherwise, it will be difficult to turn around before that, which is also why I mentioned the short-term fluctuations earlier. These two aspects are: 1. How does the central bank view this? The core question is how Powell sees it, where is the balance between employment and inflation? Is the inflation in the service sector within the PPI a one-time seasonal factor or a persistent one? With inflation rising and employment weakening, which will carry more weight in future assessments?

Personally, I expect that regarding the previous independence issue, there are indeed signs of rising inflation, making it hard for old Powell to adopt a dovish stance. It’s likely he will only make neutral statements while observing the subsequent data trends. Of course, some friends say that even if Powell's stance is neutral, it still counts as hawkish for the market. Here, we need to see how the recent fluctuations and adjustments affect market expectations.

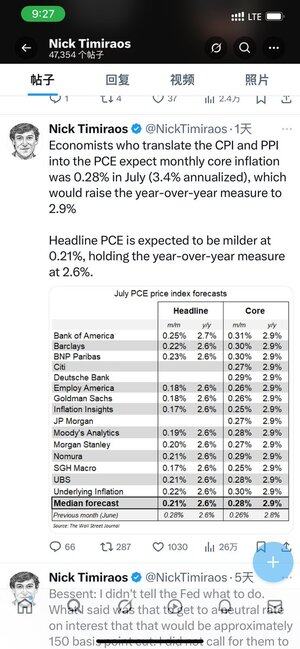

2. What will the subsequent data look like? In July, the PPI showed an increase in the service sector, indicating that while commodity inflation hasn't manifested yet, service sector inflation is starting to rise, raising concerns about future data. Therefore, the PCE data for July, which will be released next week, becomes very important. Some friends believe that the PPI has already determined that the July PCE won't be good. Looking at the expectations from institutions regarding the July PCE that Nick from the Wall Street Journal shared a couple of days ago, the expectations after the PPI are not too outrageous, which could indicate a potential expectation gap worth noting. If the data turns out to be decent, the most likely reason should be this.

18.8. klo 12.20

Last week, we discussed that the market is likely to experience short-term fluctuations, with the key point being this Friday's global central bank annual meeting. Many people may not yet be aware that the theme of this central bank meeting is "The Transforming Labor Market: Demographics, Productivity, and Macroeconomic Policy," which is very relevant to the current economic situation in the United States.

Discussions about immigration, the local population, and the productivity brought about by artificial intelligence will almost certainly be raised in all topics, whether it’s tariffs, deficit bills, the ineffectiveness of unemployment rates, capital expenditures, terminal interest rates, or earnings reports from tech stocks to consumer stocks; this critical issue cannot be avoided.

This is also the key focus of the current market: the medium to long-term upward momentum is clear, driven by fiscal expansion, industrial policy, large-scale acceleration of AI, and the process of core crypto assets entering large-scale procurement; however, short-term momentum is starting to fade, especially after last Thursday's PPI data significantly exceeded expectations, which we discussed as not being good for the market. Then, last Friday's inflation expectations also began to rise slowly. Previously, everyone believed that due to debt pressure, there would inevitably be a move towards easing, but because of the data and the potential upward risk of inflation, this expectation of inevitable easing has been undermined, which is also the underlying logic of the current fluctuations and adjustments. As mentioned in the previous tweet about the major turnover.

Returning to the central bank annual meeting, it seems that Powell's stance can be interpreted as both hawkish and dovish: the dovish expectation is that the labor market is indeed slowing down, inflation is rising moderately without a massive surge, and debt pressure is significant; the hawkish expectation is that tariffs reflected in commodity inflation are still not high, but the service sector is indeed showing stickiness, and of course, there is also an implied struggle for the independence of the Federal Reserve.

The core issue remains Powell's balance between the dual mandate of employment and inflation, and which point he leans towards is very important. Personally, I think his best stance would be neutral, not clearly stating a rate cut in September, but rather indicating that he will wait for the August employment and inflation data, which is generally neutral for the market that has fully priced in a September rate cut.

Powell also mentioned in the July interest rate meeting his new interest rate framework: the current interest rate level is at least "moderately tight." If the risk of inflation rising dominates, such a policy stance is reasonable, but if the risks of employment decline and inflation rise tend to balance, then the policy rate should be lowered to approach neutrality.

Therefore, Powell's neutral statement is seen as a short-term alleviation of market concerns, but we still need to see how the August data will verify whether the strength in the service sector from the July CPI and PPI is temporary or a trend.

25,75K

Johtavat

Rankkaus

Suosikit