Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Agree.

From last week’s MIT report:

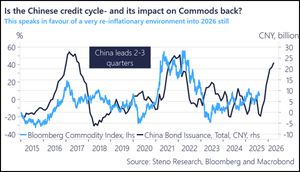

Now that bond yields in China have come lower (Phase 1 of The Everything Code), the next place to look for additional liquidity is credit creation.

Don’t get me wrong, the drop in bond yields alone is a massive easing of financial conditions in the East and a huge tailwind for global growth looking ahead. But the next place to watch is here, and credit is clearly flowing...

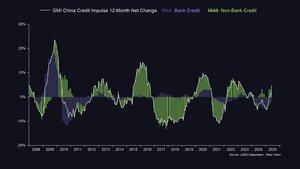

For those not familiar with the term “credit impulse,” it’s the rate of change in the flow of new credit as a percentage of GDP.

In plain English, it measures how much new credit (bank loans, shadow lending, etc.) is being pumped into the economy compared to last year. It’s not the total stock of debt, but the acceleration or deceleration of credit growth, and that’s really important.

Think of it like this: if credit is fuel for the economic engine, the credit impulse tells you whether more or less fuel is being added. A positive credit impulse means credit growth is accelerating – more money is being lent into the system, which tends to boost economic activity. A negative impulse means credit growth is slowing or shrinking, which usually drags on growth.

That’s clearly not the case today, with our GMI measure currently at its highest level since June 2023.

In fact, according to my work, outside of Japan, credit impulses across the major economies are all positive.

Historically, this has been a powerful leading indicator of global cyclical trends, especially for commodities, emerging markets, and overall industrial demand...

Bullish.

89,4K

Johtavat

Rankkaus

Suosikit