Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The L2 thesis is cracking.

Tether, Stripe, Circle - all spinning up their own L1s to compete with Ethereum, not feed into it.

Rollup security guarantees? Irrelevant when your main assets are fiat stablecoins or RWAs — they’re already centralized.

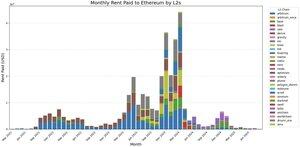

We’ve now got dozens of L2s, yet rent paid to Ethereum has collapsed back to 2021 levels. What was pitched as a structural revenue stream for ETH is now a rounding error.

L2s still do revenue - but that value increasingly sticks locally, not to Ethereum. And if L1 fees ever rise again, any large L2 with a loyal community and strong product can just become an L1 like Hyperliquid, which skipped the rollup playbook entirely.

And the “institutions will bring revenue to Ethereum” dream? Dead. The few that come are either heavily bribed to deploy, or midcurving their way into irrelevant pilots. There’s no sticky, organic institutional fee flow waiting in the wings.

ETH’s “own the L2 stack + capture institutional flows” narrative is bleeding from both ends. The upstream rent is fragile, and the big fish aren’t biting without a payout.

3,08K

Johtavat

Rankkaus

Suosikit