Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

A market, an oracle, and a dream

One area where crypto has unmistakable PMF is in the creation and trading of new markets.

Over the last few years, tokens, bonding curves, and AMMs have been the core primitives for this — great for minting net‑new, onchain native assets, and leading to an explosion of experimentation with memecoins, content coins, social tokens.

However, we’ve only barely begun to scratch the surface of new markets enabled by another crypto primitive — perpetual futures.

It makes sense why: the token deployment stack has matured over the past few years, with protocols like @dopplerprotocol continuing to push the envelope. But the permissionless perps stack is only now arriving.

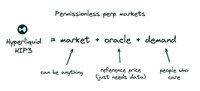

Enter @HyperliquidX's builder deployed perps (HIP3).

Hyperliquid exposes its orderbook and matching engine so builders can launch perp markets without rebuilding an exchange from scratch. Deployers define the market (specs, oracle, leverage limits), run it (maintain the oracle), and can iterate on UX and fees.

In other words, the technical challenges of creating new perp markets has been reduced to near zero, and new perp market creation is now primarily a coordination problem of flows, liquidity, and capital.

If you can find a group of people who want to speculate on a number going up or down and connect it to the real world with a credible oracle, you can create a market.

Market + oracle + demand. That’s the HIP3 recipe.

What kinds of perps markets will we see?

Zoom out and the HIP3 opportunity set looks like a distribution w/ a fat head, chunky middle, and long tail:

Fat head: The obvious high-volume stuff – S&P/Nasdaq style indices (@hyperunit), major FX pairs, core commodities. These already have robust reference prices and deep market‑maker coverage.

With HIP3, they can exist as perps without onchain spot inventory — all they need is a reliable index and counterparties willing to quote around it. And for many of these assets, perps are actually easier to list than spot because the oracle handles the tethering rather than needing to wrap the spot assets into tokens.

Chunky middle: This is where HIP3 starts to really shine – think private companies (@ventuals_), luxury goods baskets, GPU compute cost per hour, or a city’s median price per sqft for real estate.

The common trait is that a significant number of people and/or pools of capital care about a number that updates in the world and can be indexed. They want to get exposure, hedge, or speculate.

Long tail: The permissionless frontier – the price per oz of bluefin tuna in NYC, the resale price of a Tesla Model 3, the Google Trend score of an e-commerce brand, the average nightly rate of a 5 star hotel in London, or other more wacky ideas.

This is the area of experimentation where few CEXs would be willing to venture out into. But it's where builders with a strong grasp of a niche may see latent demand where others don't.

One standard, many markets

Across this entire spectrum, HIP3 keeps the mental model simple. The oracle ties the perp to a reference number, funding nudges the perp towards that number over time, and margin tiers shape the risk that traders can take on.

The deployer is accountable for the oracle definition + ongoing publication and puts up a meaningful HYPE stake, which gives traders a credible assurance that markets are being run with clear responsibilities.

And because operators have levers for differentiation, we should expect many parallel subdexes to spring up on Hyperliquid’s rails – each competing on price, depth, and UX. This competition will be great for end users.

Why is this bullish for Hyperliquid?

While HIP3 is an amazing unlock for builders, it’s also very good for Hyperliquid. Successful HIP3 markets add flow, depth, and attention to the network. The standard ascribes a meaningful share of fees back to the protocol itself, reinforcing the HYPE value accrual flywheel.

HIP3 commoditizes the exchange layer and shifts innovation to market design and demand origination. Instead of a single venue trying to list everything, Hyperliquid becomes the base infrastructure for many specialized venues.

Expect an explosion of markets and rapid natural selection by users and market-makers for which venues and perps they want to trade.

And there’s a cultural unlock here, too. Anyone with a market and demand thesis + the ability to index it can build an exchange for users to express directional views.

The next billion users

Hyperliquid’s HIP3 opens up a vast design space that didn’t exist before — markets that appeal more broadly to normies because they're tethered to *something* in the real world.

Undoubtedly some markets will fail; that’s fine. But the winners across the fat head, chunky middle, and long tail will compound volume, liquidity, and attention back into the Hyperliquid ecosystem.

As an industry, we started with tokens, bonding curves, and AMMs to create new internet native assets — some of these experiments have worked out spectacularly. For most others, the jury is still out.

With the permissionless primitive of perps, we can create new internet native markets for virtually anything that can be measured.

It'll be exciting to see what builders come up with.

HIP3RLIQUID

22,74K

Johtavat

Rankkaus

Suosikit