Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

In our interview with @DannyDayan5, he broke down his new financial conditions model that’s challenging consensus.

The Fed thinks it’s restrictive, but growth & inflation say otherwise.

Why Danny thinks the next inflation wave may be heating up ↓

Growth is rebounding, but inflation is coming with it.

➤ Q1 GDP looked weak, but stripping out noise, it was 5.8% nominal

➤ Financial conditions have eased since April despite the Fed holding steady

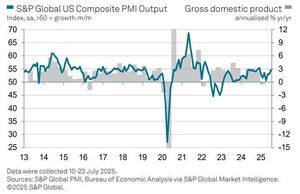

➤ PMI data suggests strong services and pricing power

The inflation pulse is bigger than the Fed admits.

Immigration is the hidden driver no one's modeling correctly.

➤ Surging immigration boosted potential growth to 3% for two years

➤ That flow collapsed in 2025, bringing potential GDP back to ~2%

➤ Now even modest growth may look inflationary

The Fed risks overtightening by misreading a shrinking labor force.

@DannyDayan5 Danny’s new framework breaks down financial conditions into growth vs inflation impulses.

➤ Equities = household wealth = demand = inflation

➤ Weaker dollar = higher import prices

➤ Bonds now reflect multiple conflicting signals

A one-index FCI doesn't cut it anymore.

The dollar is the Fed’s blindspot and it’s sending a warning.

➤ Rate cut expectations rising even as inflation swaps rise

➤ Dovish Fed tone + Trump’s potential Fed picks = credibility hit

➤ Tariffs + less trade = fewer foreign dollar holdings

Dollar weakness could unleash the next inflation wave.

Why hasn’t the market cracked yet?

➤ Equities still love 3–4% inflation if the Fed shrugs it off

➤ Dollar weakness flatters earnings and 30% of S&P 500 revs are foreign

➤ Institutions were underweight & are now forced to chase

The party continues until the bond market breaks it.

@DannyDayan5 So what trades work now?

➤ Growth ↑ + Inflation ↑ = bearish bonds, cautious risk

➤ Growth ↑ + Inflation ↓ = go max long risk

➤ Growth ↓ + Inflation ↑ = risk off, long commodities

➤ Growth ↓ + Inflation ↓ = recession trade

Dynamic frameworks beat static narratives.

@DannyDayan5 Key takeaways from @DannyDayan5:

➤ The Fed is underestimating the inflation impulse

➤ Immigration, tariffs, and FX are distorting the macro picture

➤ New tools are needed to decode modern financial conditions

➤ The dollar is the tightest constraint on policy

@DannyDayan5 Check out the full episode & more below! ↓

➤ YouTube 🎥:

➤ Apple 🎙️:

➤ Spotify 🎙️:

1,33K

Johtavat

Rankkaus

Suosikit