Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

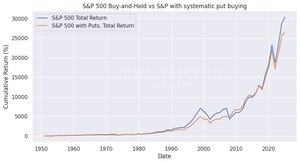

For years, we’ve heard tail risk managers make the case that a tail hedge reduces portfolio variance, allowing investors to compound returns more efficiently and ultimately achieve a higher geometric return. The claim is that allocating 1%–3% annually to a fixed-cost tail hedge improves performance compared to simply being long the S&P. Some even go as far as saying that in any 3-month, 20% drawdown in the S&P, their hedge would make the investor “whole”….meaning a 2% hedge magically offsets the losses in the remaining 98% equity allocation (S&P).

Here’s the issue. Most of these claims are built on overfit data which are anchored to extreme episodes like 2008 and 2020. When you extend the lookback to a more statistically meaningful timeframe, say 70 years instead of 20, you see a very different picture. Portfolios with high bleed tail hedges often underperform portfolios that aren’t hedged at all.

So we stress tested it. And we did everything possible to favor the tail hedge.

We modeled it as a one touch option: zero decay until year-end. No rolling, no pricing shifts, no slippage, none of the real-world drag that comes with derivatives. We assumed perfect timing: the manager exits the hedge at the top of the vol spike, covers the entire drawdown, and re-enters the S&P at the exact low. So this is basically a 2% yearly allocation in a one touch option, that as long as the S&P drops 20% in a 3M rolling window, the manager recovers the entirety of the losses on the remaining 98% their portfolio, with their hedge.

It’s pure fantasy, even for the best traders alive. And yet, we gave them that fantasy.

We also ignored fees. In reality, many tail hedge strategies charge “custom solution” premiums that amount to north of 2% in annual costs, far higher than standard hedge fund fees.

So here’s what we found: even under these absurdly favorable assumptions, simply holding the S&P outperformed the hedged portfolio.

Does that mean tail hedging is useless? Not at all. But it does mean that most static, solutions-based tail hedges—with heavy decay and unrealistic assumptions—do more harm than good.

So the next time someone says, “It doesn’t matter if the hedge loses money,” show them the math. A hedge that bleeds too much, no matter how it’s marketed, can quietly destroy a portfolio. It’s not about whether you hedge, it’s how you hedge that determines whether it adds value or just drags.

13,91K

Johtavat

Rankkaus

Suosikit